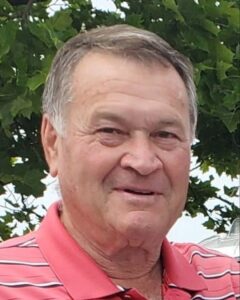

Mike Lewis

Mike Lewis is a Premier Rental Purchase franchisee with multiple stores and currently serves as Vice President of Operations. With 33 years of experience in the rent-to-own industry, he has spent the past 20 years working closely with franchisee owners and previously spent 12 years in Corporate RTO, gaining a strong foundation in the business.

For the past five years, Mike has been sharing his knowledge by teaching managers and franchisees at the company’s Training Center.

Outside of work, he enjoys time with his family, kids, and grandkids, and appreciates the simple things in life – especially riding his Harley Davidson with the sun on his face. If you know, you know!