The Federal Reserve expands its Main Street Lending Program by $600 billion. These changes include a third loan option, lowering the minimum loan size for two loans and broadening the pool of businesses eligible to borrow.

The Main Street Lending Program intends to support businesses that do not qualify for the Paycheck Protection Program — even though recipients of the PPP are still eligible for the Fed’s program — or the Economic Injury Disaster Loan, but are affected by the COVID-19 pandemic.

When comparing the Main Street Lending Program by the Fed to the Paycheck Protection Program by the Small Business Administration, Federal Reserve Chairman, Jerome Powell said, “These are not grants, these are loans. The second thing is, [the Federal Reserve] won’t run out of money. It’s not a limited pot, so there won’t be this incentive to try to get there first.”

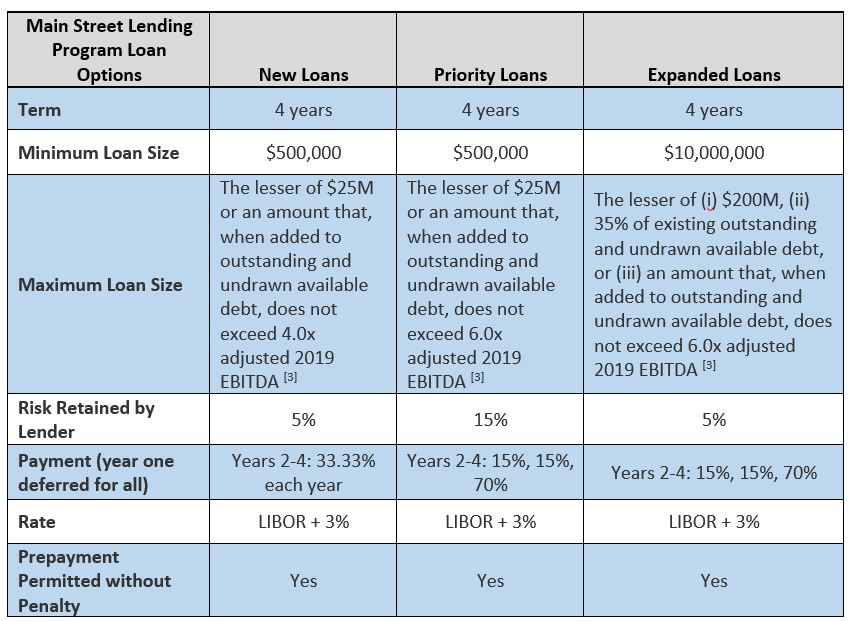

With the loan options listed as new, priority and expanded, lenders will now be further suited to measure a borrower’s income. The program changes now allow businesses with up to 15,000 employees or $5 billion in annual revenue to participate.

The minimum loan size for two of the loans in the program dropped from $1 million to $500,000. This decrease also allows more small and medium-sized businesses to be eligible for the Main Street Lending Program.

After announcing the initial terms of the program, the Fed sought public opinion for modifications to it. These new additions to the program are from the suggestions of more than 2,200 letters by individuals, businesses and nonprofits the Fed received.

The chart below explains the details of each loan. The start date of the program is unannounced.

Interested businesses should contact their lenders to discuss details and limitations of the programs, the financial position of the company and the best loan option tailored toward the company’s needs.