Did you miss any of our Q2 webinars? No worries, we’ve got you covered! Here are a few of the golden nuggets we’ve pulled out for your consideration and learning! Thank you to all of our amazing speakers – we are grateful that you continue to share your insights with us so generously.

APRIL: Advocacy Training for Legislative Conference 2025

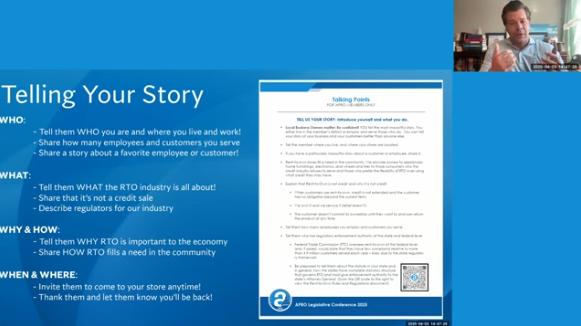

Meeks, Butera, & Israel PLLC Partner Ryan Israel from Royer and Brooks on Telling Your Story to Legislators:

“The last thing I would say is one of the most important things you can do in the meeting [with legislators] overall is to establish a connection with the staff you’re meeting with. And by that, I mean, get their business card, give them your business card, and send them a thank you note next week or the week following so they have your email address and thank them for the meeting.

And the importance of that is to have this relationship with the member of Congress, and particularly with their staff, so that when something does happen down the road, and we need you all to contact your legislators, not only do you have their phone number and email address, but you’ve got a person in the office that you can reach out to. So to build that relationship is the number one priority coming out of these meetings.”

APRO CEO Charles Smitherman on the Importance of Storytelling:

“Most of the time you sit down with these staffers or representatives, and they’re from where you are. They know where your business is. They know people from the communities that you’re involved in, your churches, your civic organizations, your schools, your sports teams, that kind of thing.

Tell them about your business, how many employees you have, how many customers you serve. We’re going to provide you with an economic impact statement that has that information broken down at a very granular level in terms of employees, tax revenue, and economic impact.

Then just share your story. That’s really what you’re there for. Storytelling is such an important part of advocacy. It helps establish these connections.”

MAY: Real Estate: A Strategic Look at Leasing, Buying, and Protecting Your Store Locations

SKC Enterprises Inc. dba Rent One CEO Larry Carrico on Considerations for Leasing versus Buying Property:

“If you’re going to put in $30,000 or $40,000 into a guy’s building, you want to make sure that you have some type of compensation or some deferment in the lease. If he’s putting a lot of money into the property, he’s going to want it the other way. He’s going to want to make sure that it’s a higher rate and a longer term. You really have to do your homework and look at the flexibility of the things that you have and understand the maintenance and the repair costs.

And the shopping centers that you’re in are important. There is a product out there right now that’ll help you find the right center. There’s a company called Placer AI, which we use to find tenants in our shopping centers.”

SKC Enterprises Inc. dba Rent One Director of Real Estate Steven Carrico on Buying Real Estate and What to Look For:

“We decided that the opportunity to purchase real estate and develop it was very valuable. So when you’re coming into either a shopping center or store setting, you’re weighing, what’s my investment? Is it $50,000 or $100,000 for a build out versus this building needs new facades and more work to it, new roofs, new parking lots. Being very aware of that property and kind of tangible aspects of it — Is it in good shape? Is it in bad shape?

As you transition into the potential for a purchase, you want to be patient and you want to know the market a little bit. You really want to be aware of what kind of condition the building is in. If you’re going to put the equity and put the sweat into making it work for you, really, really getting as familiar with that property as possible. They have companies that will provide you with a full analysis of here’s the life left on air conditioning, roofs, what kind of condition that property is in.

Most of the markets, at least a lot of the markets we’re in, are pretty simple. You’ve got main and main, you’ve got a highway that you want to be on. We’ve kind of noticed that the land isn’t quite as important as demand so it’s a little more traffic driven. It’s not as necessary to have that A plus plus location. But you get a lot of benefits when you do purchase the real estate, you get some write offs, you get some depreciation. You’ve got a fixed cost mortgage. That’s one of the big ones we’re looking at now is that mortgage is $5,000 a month for in perpetuity 20 years ago, maybe $10,000 now, but you’re not looking at the rent increases and you have the control over the building.”

JUNE: Legal Town Hall: Your Questions Answered

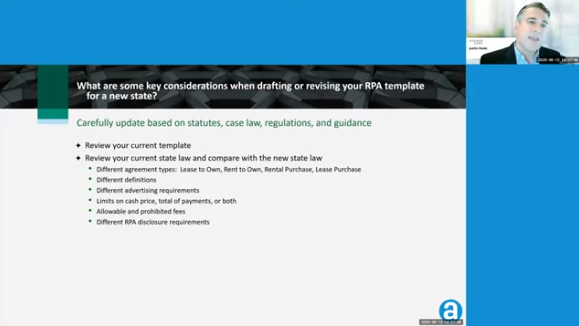

Hudson Cook LLP Partner Justin Hosie on Consideration for Drafting Agreements:

“What are some key considerations when drafting or revising your template agreement for a new state? And the really, really short answer is to be careful. You’ve got to look at the statutes. You’ve got to look at the cases. You’ve got to look at regulations and you have to look at guidance issued — sometimes it’s a state attorney general and sometimes it’s a state consumer protection division. So, you really need to scan the full menu of options in the legal world to see how things might change. One thing you should begin with is take a look at your current template even for the current state.

I can’t tell you how many times folks will come to us for an update and we’ll say, are you still using it this way in this particular state? There have been some changes or there have been some developments in your own state and you really ought to reconsider how you’re saying this. Sometimes it’s an arbitration provision in the agreement. Sometimes it’s the way a loss damage waiver is addressed or a particular fee has changed in a state. Sometimes the first step is really just do a quick kick of the tires on your current state agreement and make sure you’re comfortable with it. That’s step one always. And then from there, you’re going to review the current state law you’re operating under and the new state law.”

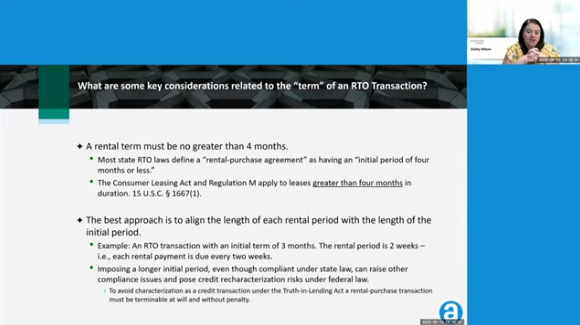

Hudson Cook LLP Partner Dailey Wilson on Rental Terms:

“The concept of a term is key in an RTO transaction, and one of the distinguishing characteristics that make it not credit. I think a lot of us, when we think of the term of a contract, we think of, in the loan context, the term of a loan contract is what it takes to get to maturity, so to pay off your balance. In an RTO transaction, the term is really each rental period under the agreement, and you can renew for a subsequent term, so it’s really important to make sure that you’re clearly describing the term in a way that doesn’t run afoul of this four-month or less limitation.

First, for state law reasons, and then second, because the Consumer Leasing Act and Regulation M, which is the federal law that governs leases, applies to only those leases that are greater than four months. So, to avoid potential application of the Consumer Leasing Act, which imposes very difficult disclosure requirements, among other things, it’s going to be important to make sure that you don’t describe your transaction as something that has 12 months or anything longer than four months.”

So, for example, a company may want to have an initial term of three months, but want rental payments to be due consistent with the consumer’s pay period, so every two weeks or whatnot, but they want the consumer to have to keep the item for the entire initial period. So, this presents some issues under federal law, and we caution against this practice because requiring the consumer to keep the item for three months or to keep paying for the item, even if they’ve returned it before the end of the initial term, results in credit re-characterization potential. The Truth in Lending Act excludes rent-to-own transactions from the definition of credit because they are one termable at will, so the consumer can terminate whenever they wish, and they can do that without penalty.”

To watch the full recordings of these webinars, visit the “Resources” tab on our website and click on “Educational Resources,” or click here. You’ll need your APRO credentials to log in. If you need help accessing these materials, please email us at info@rtohq.org.

APRO is committed to bringing you valuable, member-focused content all year long. To register for future webinars, visit: https://www.rtohq.org/upcoming-webinars/ – and don’t miss a thing!

Any topics you would like to see covered in 2026? We’re seeking speakers and ideas that address the everyday needs of RTO leaders and teams. Please submit ideas to info@rtohq.org.